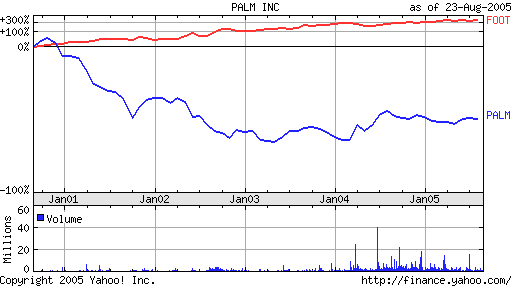

Two years ago I wrote about my inept investments and got derisively laughed at by my longtime virtual friend Andrew. “He heh” – he went – “PALM, HAND. You should have tried FOOT and LEG”. Indeed , Foothill Independent Bank and Leggett Platt Inc performed better than Handspring and Palm Inc (they merged back together now).

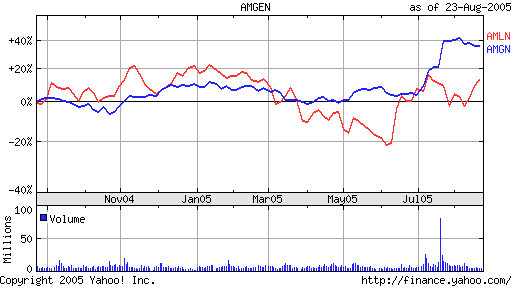

After the Internet Bubble my investment strategy closely followed the baseline advice of “A Random Walk Down Wall Street“: I maxed out my 401K with a no load S&P500 equivalent index and the like. Later I scraped together the remnants from my old non-401K investment accounts, added some money and since I seem to always pick wrong body parts to invest in, asked smartass Andrew what to buy. His recommendations were AMLN and AMGN.

For the most of the next year Amylin Pharmaceuticals was not doing so hot most of the year, and I got to heckle Andrew, saying that even his stock mojo could not overcome my bad luck investment voodoo. Yesterday Amylin popped up 28% because “Phase II clinical trials for a sustained-release formulation of Byetta showed the drug, when taken at the highest dose, could help type 2 diabetics control their blood sugar levels while losing weight“.

Overall, I am up about 30-35% for the year. I never did buy that La Marzocco, settling for a very nice Reneka Techno. La Marzocco is old news anyway, these days the object of my desire is a Syneso Cyncra. If the things go this way further, maybe some day I’ll buy one.

Ad:

Don’t even think about investing without reading “A Random Walk Down Wall Street”.

“Liar’s Poker” and “Ugly Americans” won’t teach you much about investment, but will teach you a lot about traders. Both are highly entertaining and very readable, real thrillers about BSDs. And there’s nothing “free” about them.